Are Australian house prices dropping? Here’s how much prices have risen or fallen in each capital city

Australia’s median property value is now at a record high of $753,654.

But experts are expecting prices to stabilise next year.

Property analytics company CoreLogic research director Tim Lawless said the 2024 housing market was shaping up to be very different.

“[There are] expectations that value growth will be lower and more diverse from region to region and across housing types,” he said.

“We don’t expect to see a material lift in housing activity until interest rates reduce, and that isn’t likely until the second half of next year.”

But before we get into next year, let’s look at Core Logic’s property figures from November.

What’s the most expensive city to buy in?

Data from CoreLogic says Sydney is still the most expensive place to buy a property, with a median house value of almost $1.4 million.

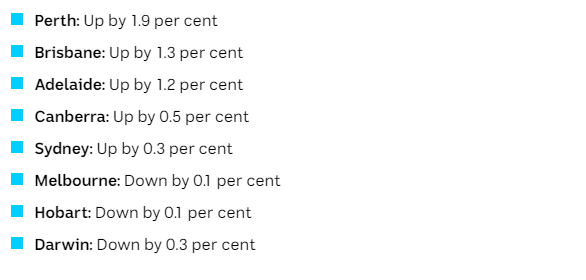

But in terms of how capital city property prices changed in November, Perth topped the list.

Meanwhile, prices decreased a fraction in Melbourne, Hobart and Darwin.

Here’s a quick rundown of how prices changed in November:

Now let’s get a more detailed look at the capital cities:

Adelaide

Monthly change: 1.2 per cent increase

Adelaide median house value: $756,989

Median unit value: $479,428

Since Adelaide property prices bottomed out in March 2023, they have risen 8.7 per cent.

Meanwhile, rental vacancy rates remained extremely tight in November at 0.3 per cent — the lowest of all capital cities.

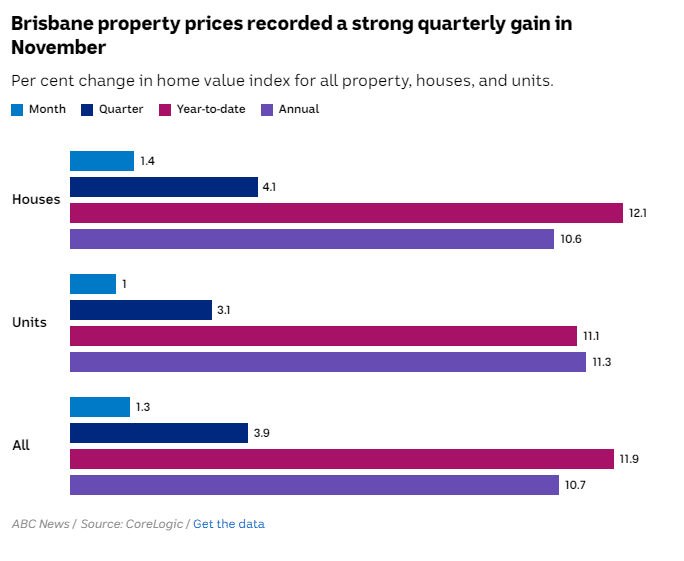

Brisbane

Monthly change: 1.3 per cent increase

Brisbane median house value: $870,526

Median unit value: $552,332

Alongside Adelaide and Perth, Mr Lawless said Brisbane property values continued to show remarkably low levels of advertised supply while purchasing activity was above average levels.

“This imbalance between available supply and demonstrated demand is keeping strong upward pressure on housing values across these markets, despite the downside factors leading to weaker housing market conditions across the lower eastern seaboard,” he said.

Canberra

Monthly change: 0.5 per cent increase

Canberra median house value: $965,378

Median unit value: $590,425

Darwin

Monthly change: 0.3 per cent decrease

Darwin median house value: $572,504

Median unit value: $380,761

Hobart

Monthly change: 0.1 per cent decrease

Hobart median house value: $702,722

Median unit value: $526,961

Hobart was one of three capital cities to record a decline in values over November, albeit a small one.

Looking at annual figures, Hobart dwellings have recorded a 3 per cent decline.

Meanwhile, rental conditions have eased in Hobart with vacancy rates sitting at 1.9 per cent — the highest across the capitals.

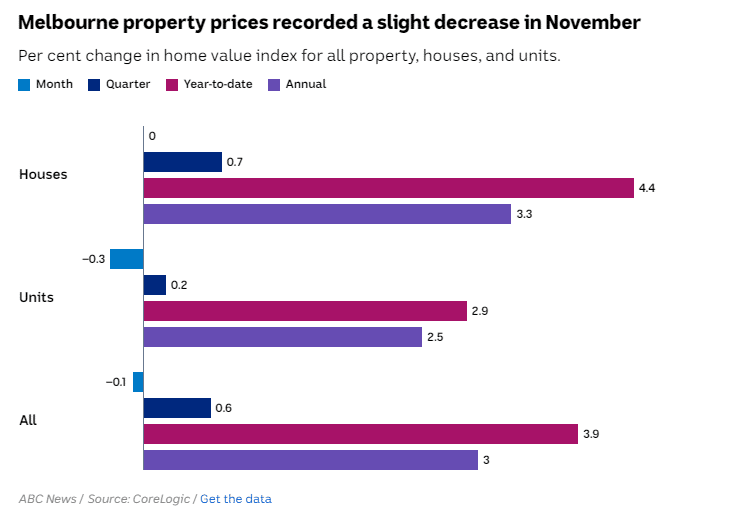

Melbourne

Monthly change: 0.1 per cent decrease

Melbourne median house value: $943,725

Median unit value: $610,490

Melbourne’s home values slipped 0.1 per cent in November, their first monthly decline since hitting the trough in January this year.

Mr Lawless said while the Melbourne Cup Day rate rise took some heat out of the market, there were other factors at play.

“Rising advertised stock levels, worsening affordability and persistently low consumer sentiment are also acting as a drag on value growth in some markets, such as Melbourne.”

Perth

Monthly change: 1.9 per cent increase

Perth median house value: $676,910

Median unit value: $457,296

It’s full steam ahead for Perth property values, rising 1.9 per cent in November — the largest monthly gain since March 2021.

The annual growth rate of property prices is now up 13.5 per cent, eclipsing that of Brisbane (10.7 per cent) and Sydney (10.2 per cent).

Listings are almost 40 per cent below their five-year average for this time of year.

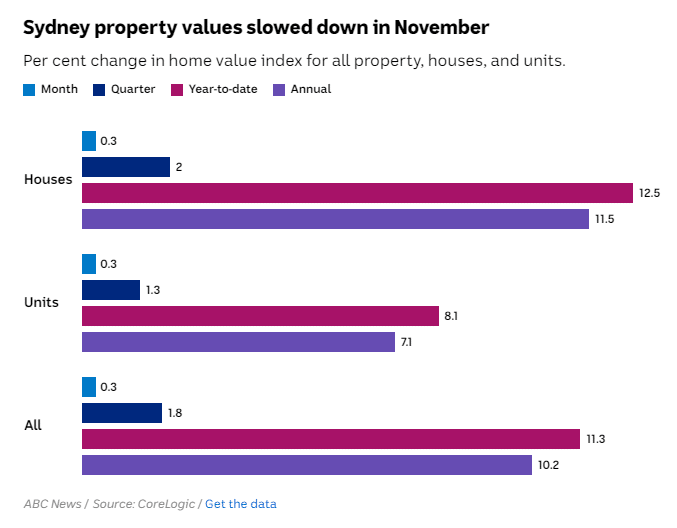

Sydney

Monthly change: 0.3 per cent increase

Sydney median house value: $1,397,366

Median unit value: $836,220

Growth in Sydney home values slowed sharply in November, lifting 0.3 per cent, which is less than half the 0.7 per cent gain recorded in October.

November’s modest rise was also the smallest monthly increase since February this year.

Mr Lawless said he believed Sydney’s housing market could be on course for a dip as early as next month.

What’s the housing market forecast for 2024?

PRD chief economist Diaswati Mardiasmo says things will get “more unaffordable” in the new year but we could see “breakthroughs” towards the end of the year.

She says the outlook will be driven by a number of trends.

“We are going into the new year with low supply and increasing demand, a higher cash rate, lower savings and people prioritising primary needs versus secondary.

“At the same time, governments are trying to stimulate supply and people are also ‘getting used to’ the higher cash rates and changing economic landscape.

“Therefore, the first quarter may not feel any different, other than perhaps some areas starting to see a recovery in house prices.

“This will feel like there’s no hope as everything becomes more unaffordable.

“However, as we innovate through this resilience we will start to see some breakthroughs, all of which we will feel more towards the later part of 2024 as inflation and the cash rate lower.”